Post Office Monthly Income Scheme (MIS) 2025 offers safe monthly income with 7.4% interest. Check eligibility, investment limits, tax rules, and benefits.

When it comes to safe investments that offer a steady monthly income, very few options in India can match the reliability of the Post Office Monthly Income Scheme (MIS). Backed by the Government of India, this scheme is especially popular among retirees, senior citizens, homemakers, and conservative investors who want predictable cash flow without market risk.

In this detailed guide, we will explain everything you need to know about the Post Office MIS account in 2025—including interest rates, eligibility, investment limits, taxation, benefits, and who should invest in it.

Table of Contents Post Office Monthly Income Scheme

What Is the Post Office Monthly Income Scheme (MIS)?

The Post Office Monthly Income Scheme is a government-backed small savings scheme operated by India Post. Under this scheme, an investor deposits a lump sum amount and earns fixed interest every month for a period of five years.

The principal amount remains fully protected, and interest is paid regularly, making MIS a preferred option for people who depend on monthly income to manage household expenses.

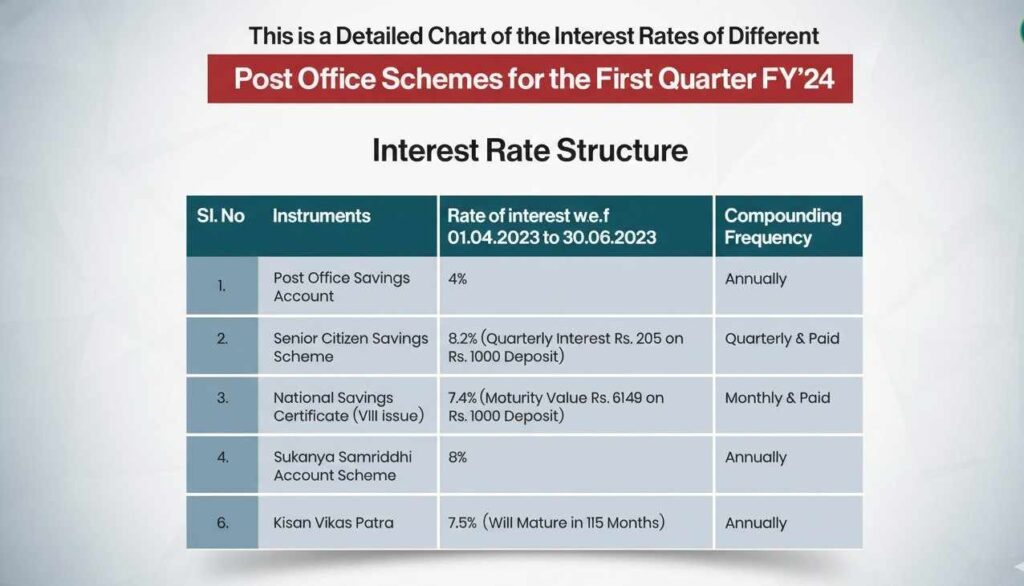

Post Office Monthly Income Scheme Interest Rate in 2025

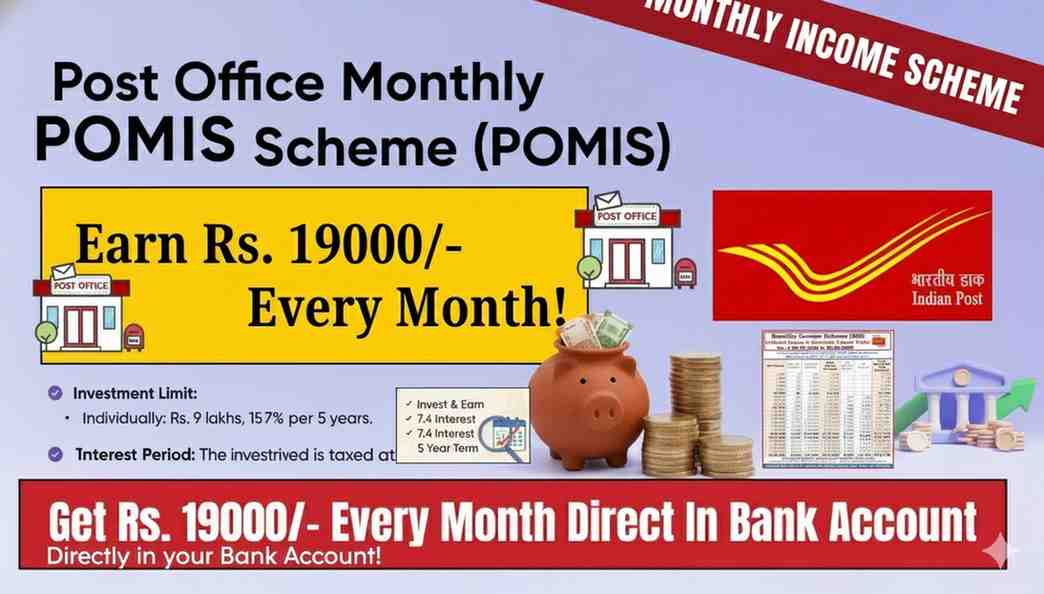

As of 2025, the interest rate for Post Office MIS is 7.4% per annum, payable monthly.

Key points to understand: Post Office Monthly Income Scheme

- Interest is calculated on the deposited amount

- It is not compounded

- Interest is credited every month to the linked savings account

- Rates are reviewed periodically for new accounts by the government

Example

If you invest ₹900,000 in a single MIS account:

Annual interest = ₹66,600

Monthly income ≈ ₹5,550

- This predictable monthly payout is one of the biggest reasons investors prefer MIS.

- Minimum and Maximum Investment Limits

- Free Mobile Yojana Apply Online 2025 : Eligibility & Status

- Post Office Monthly Income Scheme (MIS): Interest Rate, Eligibility, Benefits & How It Works in 2025.

- Sukanya Samriddhi Yojana: A Complete Guide to India’s Best Saving Scheme for Girl Child.

- Best Foods for Glowing Skin: 10 Best Foods & Nutrition Tips for Glowing Skin Naturally.

- Smartphone Yojana 2025: Free Mobile Scheme, Eligibility, Online Apply & Benefits.

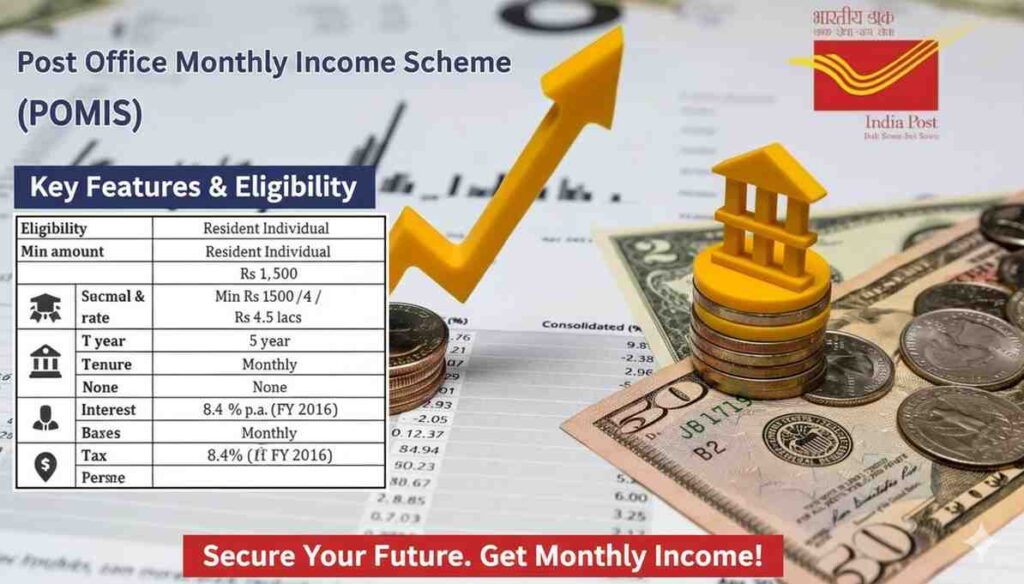

The investment limits under Post Office MIS are clearly defined:

- Minimum investment: ₹1,000 (in multiples of ₹1,000)

- Maximum investment:

- ₹9 lakh in a single account

- ₹15 lakh in a joint account

An individual is allowed to open more than one MIS account, but the total investment across all accounts must remain within the prescribed limit.

Eligibility Criteria for Post Office MIS Account

The scheme is open only to resident Indian citizens. Eligible categories include:

- A single adult individual

- Joint account (up to three adults)

- A guardian on behalf of a minor

- A guardian on behalf of a person of unsound mind (Authorised Bank Account)

- A minor who has attained the age of 10 years can operate the account independently

Not eligible:

- Non-Resident Indians (NRIs)

- Hindu Undivided Families (HUFs)

Types of Post Office MIS Accounts

- Single Account

Opened and operated by one individual.

- Joint Account

Can be opened by up to three adults. There are two types:

- Joint ‘A’ Type: Operated jointly by all account holders

- Joint ‘B’ Type: Operated by any one of the account holders

- In joint accounts, the investment limit applies to the account as a whole, not individually.

Tenure and Maturity of MIS Account

The Post Office MIS account has a fixed tenure of 5 years.

At maturity:

- The entire principal amount is returned

- Monthly interest payments stop

- The investor may choose to reinvest the amount in a new MIS account (subject to prevailing rules)

Monthly Interest Payment Process

- Interest under MIS is

- Paid every month

- Credited directly to the customer’s Post Office Savings Account

- Not reinvested automatically

The first interest payment is usually made one month after account opening. If interest is not withdrawn in a particular month, it does not earn additional interest.

Premature Closure Rules : post office scheme

Premature closure is allowed, but with conditions:

- Before 1 year: Not allowed

- After 1 year but before 3 years:

- 2% of the principal amount is deducted

- After 3 years but before 5 years:

- 1% of the principal amount is deducted

- This structure encourages investors to stay invested for the full tenure.

Taxation on Post Office MIS

Tax treatment is an important factor to consider:

- Interest earned is fully taxable

- No TDS is deducted by the Post Office

- MIS does not qualify for deduction under Section 80C

- Tax liability depends on the investor’s income tax slab

- Investors should plan their taxes accordingly, especially if MIS interest forms a significant portion of their income.

- Advantages of Post Office Monthly Income Scheme

The MIS scheme offers several practical benefits:

- Guaranteed monthly income

- Government-backed security

- Zero market risk

- Simple and transparent structure

- Ideal for fixed cash flow requirements

- Suitable for conservative investors

- MIS is best viewed as a stable income product, not a high-return investment.

Limitations of the MIS Scheme

- Despite its safety, MIS has some limitations:

- No tax-saving benefits

- Returns may not beat inflation in the long term

- Interest is not compounded

- Interest rates may change for future accounts

Understanding these limitations helps investors have realistic expectations.

MIS vs Other Monthly Income Options

- MIS vs. Fixed Deposit: MIS offers regular monthly income, while FD may require manual interest payouts.

- MIS vs Senior Citizen Saving Scheme (SCSS): SCSS offers higher interest but is limited to senior citizens.

- MIS vs Mutual Fund SWP: SWP may provide higher returns but involves market risk.

- MIS stands out as a low-risk, predictable income option.

How to Open a Post Office MIS Account

- Opening an MIS account is simple:

- Visit the nearest post office.

- Fill out the MIS account opening form

- Submit KYC documents (Aadhaar, PAN, address proof, photographs)

- Deposit the amount via cash or check.

- Link a Post Office Savings Bank Account for interest credit.

- Some services may also be accessible through India Post’s digital platform, depending on location.

Who Should Invest in Post Office MIS?

The MIS scheme is ideal for:

- Retired individuals

- Homemakers seeking regular income

- Conservative investors

- Anyone looking for safe and predictable monthly returns

- It is particularly useful for managing routine household expenses.

Note: This article is for informational purposes only. Please verify details from official sources before taking any decision.

Ok sir

Ok

Very Good Information 😃